When it comes to home improvement projects, one name always stands out: Home Depot. And let me tell you, their interest-free promotions are like finding gold in a toolbox. Imagine walking into the store or browsing online, knowing you can score big on upgrades without worrying about interest piling up. Sounds like a dream, right? Well, buckle up because we're diving deep into everything you need to know about Home Depot's interest-free offers.

Now, let's be real for a second. Home Depot is not just your average hardware store. They're like the superheroes of home improvement, offering everything from power tools to landscaping supplies. But what truly sets them apart are those sweet, sweet promotions that let you finance big-ticket items without the stress of interest charges. Whether you're redoing your kitchen or building a backyard oasis, these deals are worth exploring.

Before we get too deep into the nitty-gritty, let's address the elephant in the room. Most people hear "interest-free" and assume it's too good to be true. Spoiler alert: it's not! But there are some important details you need to know to make the most of these offers. Stick around, and I'll break it all down for you in a way that's easy to understand and actionable. Trust me, your wallet will thank you later.

Read also:Access North Ga Your Ultimate Guide To Unlocking The Hidden Gems

Understanding Home Depot Interest-Free Promotions

What Exactly Are Interest-Free Promotions?

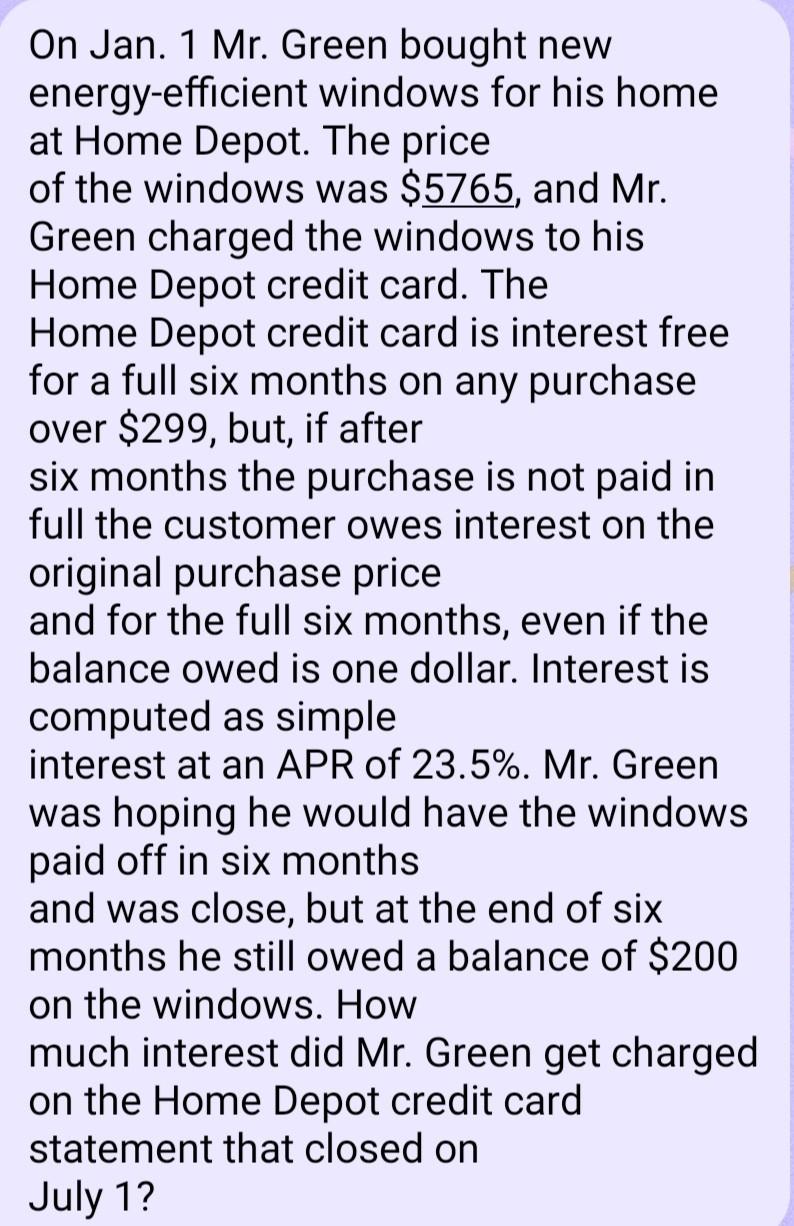

Let’s cut to the chase. Home Depot's interest-free promotions are essentially financing options that allow you to pay for purchases over time without accumulating interest—*if* you meet certain conditions. Think of it as a grace period where you can spread out payments without worrying about extra charges. For example, you might see offers like "No Interest if Paid in Full Within 12 Months" or "6 Months Special Financing."

These promotions are designed to help you tackle larger projects without breaking the bank upfront. Whether you're upgrading your bathroom, installing new appliances, or even buying outdoor furniture, the interest-free option makes it easier to manage costs. Just remember, there's usually a minimum purchase amount required to qualify for these deals.

Who Qualifies for These Deals?

Here's the good news: pretty much anyone can qualify for Home Depot's interest-free promotions, but there are a few prerequisites. First, you’ll need to apply for the Home Depot Credit Card or use an existing one. The application process is straightforward, and approval often happens quickly. If you have decent credit, chances are you’ll get the green light.

Once approved, you’ll gain access to exclusive financing offers, including the interest-free promotions. Keep in mind that these deals are typically available during specific promotional periods, so it pays to stay on top of when they’re running. Pro tip: sign up for Home Depot emails or follow them on social media to catch these deals as soon as they drop.

How Do Interest-Free Promotions Work?

The Mechanics Behind the Magic

Alright, here’s how it works. When you take advantage of an interest-free promotion, you essentially enter into a deferred interest agreement. This means you won’t accrue interest during the promotional period—as long as you pay off the entire balance before the period ends. If you don’t, though, any remaining balance will start accruing interest retroactively from the original purchase date. Yikes!

So, what does this mean in practice? Let’s say you buy a $1,000 pressure washer with a 12-month interest-free promotion. If you pay off the full $1,000 within those 12 months, you avoid paying any interest. But if you still owe $200 after the 12 months are up, that $200 will now carry interest charges going back to the day you made the purchase. Clear as mud? Good!

Read also:Scarlett Johansson Has Kids Unveiling The Truth About Her Family Life

Breaking Down the Terms and Conditions

Every promotion comes with its own set of terms, so it’s crucial to read the fine print. Here are a few key points to keep in mind:

- Promotional Period: The length of time you have to pay off your purchase without interest. Common durations include 6, 12, or even 18 months.

- Minimum Purchase Requirement: Some promotions require you to spend a certain amount to qualify, like $399 or $599.

- Eligible Items: Not all products may be eligible for interest-free financing. Always check which items are included in the promotion.

- Payment Deadlines: Missing a payment can disqualify you from the interest-free offer, so set reminders and stay on top of your payments.

Remember, knowledge is power. The more you understand the terms, the better equipped you’ll be to make the most of these promotions.

Benefits of Using Home Depot’s Interest-Free Financing

Why Should You Care About These Promotions?

Here’s the deal: home improvement projects can get expensive fast. From materials to labor, costs add up quickly. That’s where Home Depot’s interest-free promotions come in handy. By allowing you to spread out payments over several months without interest, they make it easier to budget for larger purchases. Plus, it gives you the flexibility to tackle multiple projects without feeling overwhelmed financially.

Another major benefit? Building credit. Responsible use of the Home Depot Credit Card—like paying off balances on time—can positively impact your credit score. Over time, this could lead to better loan terms, lower interest rates, and more financial opportunities.

Saving Money Without Sacrificing Quality

Let’s face it: when you’re shopping for high-quality tools, appliances, or building materials, price tags can be intimidating. But with Home Depot’s interest-free promotions, you can invest in top-tier products without the immediate sticker shock. And let’s not forget about the added perks, like discounts, cashback offers, and rewards points that come with the Home Depot Credit Card.

Potential Pitfalls to Watch Out For

Avoiding the Deferred Interest Trap

While interest-free promotions sound amazing, they do come with potential pitfalls. The biggest one? Deferred interest. As we discussed earlier, failing to pay off the full balance by the end of the promotional period can result in retroactive interest charges. This can quickly turn a great deal into a financial headache.

To avoid this trap, always calculate your monthly payments ahead of time and ensure you can comfortably meet them. Setting up automatic payments is another smart move to ensure you never miss a deadline.

Managing Credit Card Debt Wisely

Another thing to consider is the overall impact on your credit card debt. While the interest-free period is a boon, relying too heavily on credit can lead to long-term financial struggles if not managed carefully. Stick to a budget, prioritize paying off balances, and resist the temptation to overspend just because you have access to financing.

Maximizing Your Interest-Free Promotion Experience

Strategies for Success

Ready to make the most of Home Depot’s interest-free promotions? Here are a few strategies to keep in mind:

- Plan Ahead: Know exactly what you need before heading to the store. This helps you avoid impulse buys and ensures you’re only financing necessary purchases.

- Track Payments: Use a spreadsheet or budgeting app to monitor your progress toward paying off the balance. Seeing your progress visually can be incredibly motivating.

- Combine Offers: Look for opportunities to stack promotions. For example, if Home Depot is offering both an interest-free financing deal and a percentage discount on eligible items, take advantage of both.

Staying Organized

Organization is key to successfully navigating interest-free promotions. Keep all receipts, emails, and documentation related to your purchases in one place. This way, you’ll have everything you need if questions arise or if you need to dispute a charge. Additionally, setting calendar reminders for payment due dates can help you stay on track.

Data and Statistics to Support Your Decision

The Numbers Don’t Lie

According to recent surveys, over 60% of homeowners plan to invest in home improvements within the next year. With costs ranging from $500 to $10,000 per project, financing options like Home Depot’s interest-free promotions become incredibly valuable. In fact, customers who utilize these offers report saving an average of $300 to $500 per purchase compared to paying with traditional credit cards.

Additionally, data shows that responsible use of credit cards with deferred interest options can significantly boost credit scores over time. One study found that users who consistently paid off balances during promotional periods saw an average increase of 50 points in their credit scores after two years.

Conclusion: Take Action Today

Home Depot’s interest-free promotions offer a fantastic opportunity to upgrade your living space without the added stress of interest charges. By understanding how these deals work, planning carefully, and managing your finances responsibly, you can enjoy significant savings while improving your home.

So, what’s next? If you’re ready to jump in, start by applying for the Home Depot Credit Card or checking out current promotions online. And don’t forget to share this guide with friends and family who might benefit from it. Together, let’s turn those home improvement dreams into reality—one interest-free purchase at a time.

Table of Contents

- Understanding Home Depot Interest-Free Promotions

- How Do Interest-Free Promotions Work?

- Benefits of Using Home Depot’s Interest-Free Financing

- Potential Pitfalls to Watch Out For

- Maximizing Your Interest-Free Promotion Experience

- Data and Statistics to Support Your Decision

- Conclusion: Take Action Today