Let’s be real, folks—investing in the stock market can feel like diving into an ocean full of sharks. But what if I told you there’s a safer, smarter, and more accessible way to ride the waves of the financial world? Enter ETFs (Exchange-Traded Funds), and let’s zoom in on why platforms like Fintechzoom and Vanguard are making waves in the ETF market. Whether you’re a seasoned investor or just dipping your toes into the water, this guide is about to level up your game.

Now, hold onto your hats because we’re about to break down the ins and outs of ETFs, the role of fintech platforms like Fintechzoom, and why Vanguard is the big kahuna in this space. We’ll cover everything from the basics to advanced strategies so you can make informed decisions that’ll keep your portfolio growing like a weed in summer.

But before we dive deep, let’s get one thing straight: this isn’t just another article about numbers and graphs. This is your roadmap to understanding how ETFs work, why they’re a game-changer, and how to leverage tools like Fintechzoom and Vanguard to build wealth. Ready? Let’s go!

Read also:Kyle Cheney And Liz Cheney The Family Connection You Need To Know

Table of Contents:

- What is an ETF?

- Fintechzoom Com ETF Market

- Vanguard ETF Overview

- Benefits of Investing in ETFs

- Types of ETFs

- How to Buy ETFs

- Market Trends in ETFs

- Vanguard vs Other Platforms

- Risks of ETFs

- Conclusion: Your Path to ETF Success

What is an ETF?

Alright, let’s start with the basics. An ETF, or Exchange-Traded Fund, is essentially a basket of securities—stocks, bonds, commodities, you name it—that trades on an exchange just like a regular stock. Think of it as a smoothie where all the ingredients are carefully blended to give you a balanced and diverse taste. ETFs offer diversification, flexibility, and lower costs compared to traditional mutual funds, making them super attractive to both newbies and pros.

And here’s the kicker: ETFs can be bought and sold throughout the trading day at market prices, unlike mutual funds which are priced at the end of the day. So, if you’re someone who likes to have control over your investments, ETFs are your new best friend.

Why ETFs Are Popular

Let me break it down for you. ETFs are like the Swiss Army knife of investments. They’re versatile, efficient, and pack a punch. Here’s why they’ve become so popular:

- Low fees—seriously, we’re talking rock-bottom expense ratios.

- Easy to trade—buy and sell them just like stocks.

- Diversification—you can own a piece of hundreds or even thousands of companies with one ETF.

- Transparency—you know exactly what’s in your ETF because they publish their holdings daily.

And if you’re thinking, “Wait, what about taxes?” Don’t sweat it. ETFs are often more tax-efficient than mutual funds, which means more money stays in your pocket. Now, who doesn’t love that?

Fintechzoom Com ETF Market

So, what’s the deal with Fintechzoom? Well, Fintechzoom is one of those fintech platforms that’s all about democratizing access to financial markets. It’s like a digital gateway where retail investors can explore, research, and trade ETFs without feeling like they’re in over their heads.

Read also:Reese Colton Allison Today The Rising Star Shining Brighter Than Ever

What Makes Fintechzoom Stand Out?

Here’s the thing: Fintechzoom isn’t just another platform throwing numbers at you. It’s designed to simplify the ETF market and make it accessible to everyone. Whether you’re a tech-savvy millennial or someone who’s just starting to dabble in investing, Fintechzoom has got your back.

Some standout features include:

- Comprehensive ETF research tools—get all the data you need to make smart decisions.

- User-friendly interface—no more confusing jargon or complicated charts.

- Real-time updates—stay on top of market trends as they happen.

- Community engagement—connect with other investors and share insights.

And let’s not forget, Fintechzoom is all about empowering investors with knowledge. They offer educational resources, webinars, and expert analysis to help you navigate the ETF market like a pro.

Vanguard ETF Overview

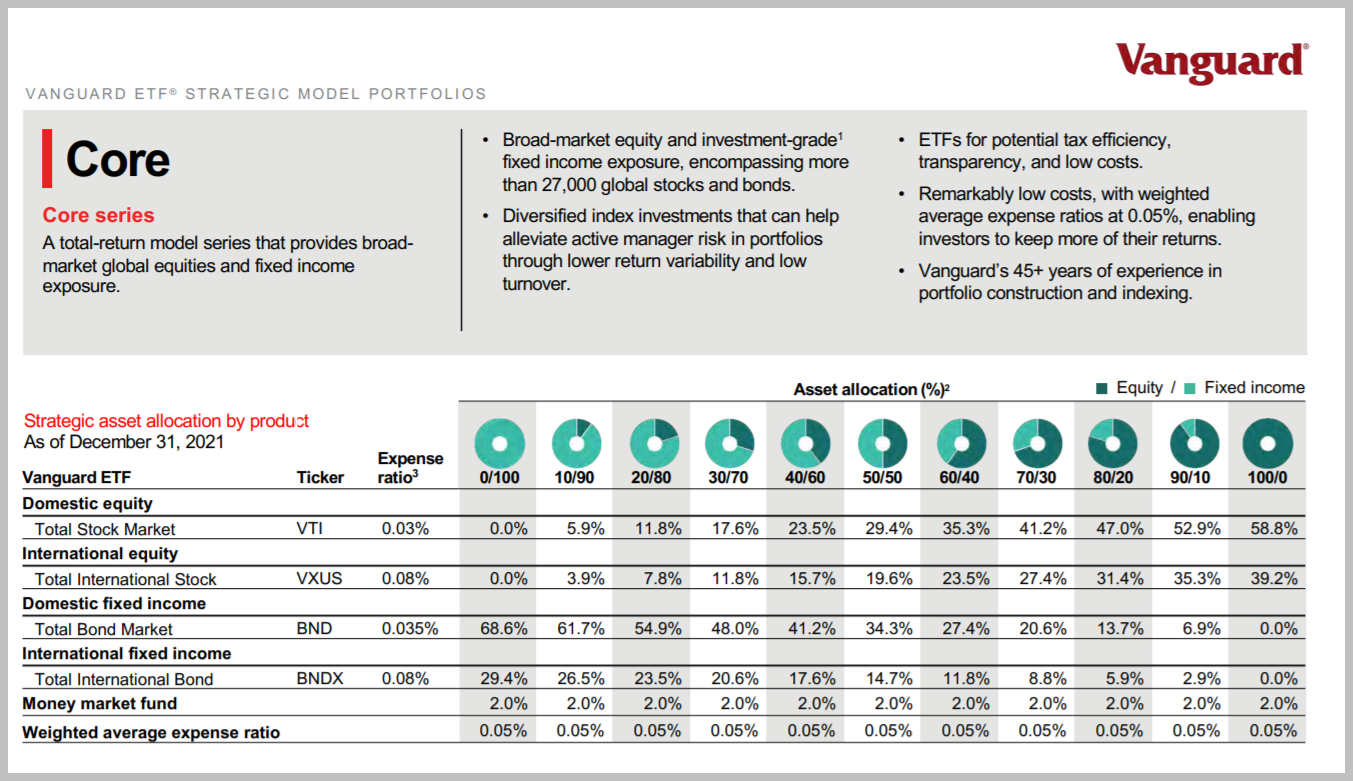

Now, let’s talk about the elephant in the room—Vanguard. If you haven’t heard of Vanguard, where’ve you been? Vanguard is one of the biggest names in the ETF game, and for good reason. They’re known for their low-cost ETFs, rock-solid reputation, and commitment to delivering value to investors.

Why Vanguard ETFs Are a Big Deal

Vanguard ETFs are like the gold standard in the investment world. Here’s why:

- Low expense ratios—some of the cheapest in the industry.

- Wide range of options—from broad-market ETFs to niche offerings.

- Strong performance—Vanguard ETFs consistently deliver solid returns.

- Investor-friendly policies—Vanguard puts investors first, always.

And if you’re worried about liquidity, don’t be. Vanguard ETFs are highly liquid, meaning you can buy and sell them without breaking a sweat. Plus, they’ve got a massive investor base, which adds to their stability and reliability.

Benefits of Investing in ETFs

Let’s face it, folks—investing is all about maximizing returns while minimizing risks. And ETFs are a great way to strike that balance. Here are some of the key benefits:

- Cost-Effective: Lower fees compared to mutual funds.

- Diversification: Spread your risk across multiple assets.

- Flexibility: Trade them whenever the market is open.

- Tax Efficiency: Minimize your tax burden.

- Transparency: Know exactly what you’re investing in.

And if you’re thinking, “But what about market volatility?” ETFs can actually help smooth out those bumps in the road. By diversifying your portfolio, you reduce the impact of any one stock or sector underperforming.

Types of ETFs

Not all ETFs are created equal. There are different types of ETFs catering to various investment goals. Let’s take a look:

Stock ETFs

These ETFs track a specific stock index, like the S&P 500. They’re great for gaining exposure to a broad market or specific sectors.

Bond ETFs

Looking for stability? Bond ETFs are your go-to for fixed-income investments. They provide regular income streams and diversification.

Commodity ETFs

Want to invest in gold, oil, or other commodities without buying physical assets? Commodity ETFs make it easy.

International ETFs

Expand your horizons with international ETFs that give you access to global markets. Perfect for diversifying beyond your home country.

How to Buy ETFs

Buying ETFs is simpler than you might think. Here’s a step-by-step guide:

- Choose a Broker: Pick a reputable broker that offers ETFs. Fintechzoom and Vanguard are great options.

- Open an Account: Sign up for an account and complete the verification process.

- Fund Your Account: Deposit money into your account using a bank transfer or other methods.

- Research ETFs: Use tools like Fintechzoom to find the right ETFs for your portfolio.

- Place Your Order: Enter your order, specify the quantity, and hit the buy button.

And there you have it! You’re now an ETF owner. Congrats!

Market Trends in ETFs

The ETF market is constantly evolving, and staying on top of trends is key to making smart investment decisions. Here are some trends to watch:

- ESG Investing: Environmental, Social, and Governance (ESG) ETFs are gaining traction as investors prioritize sustainability.

- Thematic ETFs: These ETFs focus on emerging themes like technology, healthcare, and renewable energy.

- Smart Beta ETFs: These ETFs use advanced strategies to outperform traditional market-cap-weighted indexes.

- Global Expansion: More ETFs are offering exposure to international markets, giving investors global opportunities.

As the market continues to grow, expect even more innovation and diversity in the ETF space.

Vanguard vs Other Platforms

So, how does Vanguard stack up against other platforms? Here’s a quick comparison:

| Platform | Expense Ratios | Product Range | Customer Support |

|---|---|---|---|

| Vanguard | Ultra-low | Extensive | Top-notch |

| Other Platforms | Varies | Varies | Varies |

While other platforms may offer cool features or unique ETFs, Vanguard’s commitment to low costs and investor-friendly policies often gives it the edge.

Risks of ETFs

Now, let’s talk about the elephant in the room—risks. While ETFs are generally considered safe, they’re not without risks. Here are a few things to keep in mind:

- Market Risk: ETFs are subject to market fluctuations, so prices can go up or down.

- Liquidity Risk:

- Tracking Error: Some ETFs may not perfectly track their underlying index.

- Concentration Risk: Certain ETFs may have heavy exposure to specific sectors or assets.

But here’s the good news: by doing your homework and diversifying your portfolio, you can mitigate these risks and set yourself up for success.

Conclusion: Your Path to ETF Success

Alright, let’s wrap this up. ETFs are a powerful tool for building wealth, and platforms like Fintechzoom and Vanguard are making it easier than ever to access them. Whether you’re looking to diversify your portfolio, gain exposure to new markets, or simply grow your wealth, ETFs offer a flexible and cost-effective solution.

So, what are you waiting for? Dive into the world of ETFs, explore the market, and take control of your financial future. And remember, the more you learn, the better equipped you’ll be to make smart investment decisions.

Got questions or insights? Drop a comment below and let’s keep the conversation going. Happy investing, folks!