Let’s talk about something that could save you a pretty penny—Home Depot’s interest-free financing for 18 months. Yep, you heard that right! If you’re planning to upgrade your home, buy some fancy appliances, or even tackle a major renovation, this deal could be your golden ticket. But hold up, there’s more to it than meets the eye. In this article, we’ll break down everything you need to know about Home Depot’s 18-month interest-free offer so you don’t get caught off guard.

Imagine walking into Home Depot with a shopping cart full of dream-worthy items—new kitchen cabinets, that state-of-the-art fridge you’ve been eyeing, or even a sleek gas grill for your backyard—and knowing you can pay it off over time without any interest. Sounds too good to be true? Well, it’s not if you play your cards right. But before you whip out your credit card, let’s dive into the details to make sure you’re making the smartest financial decision possible.

This article isn’t just about explaining the offer; it’s about equipping you with the knowledge to navigate the fine print, avoid hidden fees, and make the most out of your Home Depot shopping spree. So grab a cup of coffee, sit back, and let’s get into it!

Read also:Karryns Prison The Untold Story Of Survival Justice And Redemption

Table of Contents

- What is Home Depot Interest Free 18 Months?

- Who is Eligible for This Offer?

- How Does the 18-Month Interest-Free Financing Work?

- Pros and Cons of Home Depot’s No Interest Offer

- Common Mistakes to Avoid

- Best Ways to Use the Interest-Free Financing

- Payment Options and Flexibility

- Frequently Asked Questions About Home Depot Financing

- Tips to Maximize Your Savings

- Final Thoughts on Home Depot Interest-Free Financing

What is Home Depot Interest Free 18 Months?

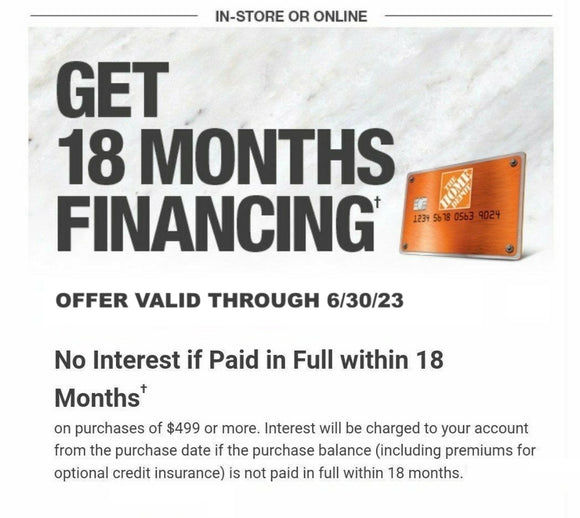

Alright, let’s start with the basics. The Home Depot interest-free 18 months is essentially a promotional financing offer that allows you to purchase qualifying items without paying any interest for 18 months. It’s like having a grace period where you can pay off your balance without worrying about extra charges, as long as you stick to the rules.

This offer typically comes with the Home Depot Credit Card or the Home Depot Consumer Credit Card, which are co-branded with Synchrony Bank. It’s a pretty sweet deal if you’re looking to spread out the cost of a big purchase over time without incurring interest. But remember, if you don’t pay off the balance within the 18 months, you’ll end up paying interest retroactively from the date of purchase. So, it’s crucial to plan ahead!

How It Differs from Regular Credit Cards

Unlike regular credit cards, which charge interest on your purchases from day one unless you pay off the balance in full each month, Home Depot’s interest-free financing gives you a window of opportunity to pay off your purchases without any added costs. This makes it an excellent option for large home improvement projects or appliance upgrades.

Who is Eligible for This Offer?

To take advantage of Home Depot’s interest-free financing, you’ll need to apply for either the Home Depot Credit Card or the Home Depot Consumer Credit Card. Approval depends on your creditworthiness, so having a good credit score is key. If you’ve got a solid credit history, chances are you’ll qualify for this offer.

But here’s the kicker: not all purchases are eligible for the 18-month interest-free deal. Typically, the offer applies to specific categories like appliances, flooring, furniture, and other big-ticket items. So, before you start shopping, make sure the items you want are included in the promotion.

Key Factors for Approval

- Good credit score (typically above 670)

- Stable income and employment history

- No recent late payments or defaults

How Does the 18-Month Interest-Free Financing Work?

Now that we’ve covered the basics, let’s dive deeper into how this financing works. When you sign up for the Home Depot Credit Card, you’ll get access to the 18-month interest-free period on qualifying purchases. Here’s how it breaks down:

Read also:When Will Jared Fogle Be Released The Inside Scoop Youve Been Waiting For

1. **Purchase Qualifying Items:** Make sure the items you’re buying fall under the categories eligible for the promotion. This usually includes appliances, furniture, and major home improvement products.

2. **Pay Off Balance Within 18 Months:** To avoid interest charges, you need to pay off the entire balance before the promotional period ends. If you don’t, you’ll be charged interest on the original purchase amount from the date of purchase.

3. **Monthly Payments:** While there’s no interest during the 18 months, you’re still required to make minimum monthly payments. Missing payments can lead to penalties and even disqualification from the interest-free offer.

What Happens If You Don’t Pay It Off?

If you fail to pay off the balance within the 18 months, you’ll be hit with retroactive interest charges. This means you’ll be charged interest on the original purchase amount from the day you made the purchase. It’s like the deal was never there, so it’s super important to have a repayment plan in place from the get-go.

Pros and Cons of Home Depot’s No Interest Offer

Like any financial product, Home Depot’s interest-free financing has its pros and cons. Let’s weigh them out so you can make an informed decision.

Pros

- No interest for 18 months on qualifying purchases

- Great for spreading out the cost of big-ticket items

- Builds credit history if managed responsibly

Cons

- Retroactive interest charges if not paid off in full

- Not all purchases are eligible for the promotion

- Potential for overspending due to the perceived affordability

Common Mistakes to Avoid

While Home Depot’s interest-free financing can be a game-changer, it’s easy to fall into some common traps. Here are a few mistakes to watch out for:

1. **Not Reading the Fine Print:** Make sure you understand the terms and conditions of the offer. Some items might not be eligible, and there could be restrictions on how you use the card.

2. **Ignoring Monthly Payments:** Even though there’s no interest for 18 months, you still need to make minimum payments each month. Missing payments can lead to penalties and affect your credit score.

3. **Overspending:** With the promise of no interest, it’s tempting to buy more than you need. Stick to a budget and only purchase what you can realistically pay off within the promotional period.

How to Stay on Track

Set up automatic payments, create a repayment plan, and regularly check your balance to ensure you’re on track to pay off the balance before the 18 months are up. It’s all about discipline and smart financial management.

Best Ways to Use the Interest-Free Financing

Now that you know how it works and what to avoid, let’s talk about the best ways to use Home Depot’s interest-free financing. Here are a few ideas:

- Major kitchen renovations

- Purchasing high-end appliances

- Installing new flooring or countertops

- Buying furniture for a new home

These are all big-ticket items that can significantly impact your home’s value and comfort. By spreading out the cost over 18 months, you can make these improvements without breaking the bank.

Payment Options and Flexibility

When it comes to paying off your balance, Home Depot offers a few options to make it easier. You can set up automatic payments, pay online, or even make payments in-store. It’s all about finding a method that works best for you and sticking to it.

Additionally, if you find yourself struggling to pay off the balance within the 18 months, you might have the option to refinance or transfer the balance to another card with a lower interest rate. Just be sure to check the terms and any associated fees before making a decision.

Frequently Asked Questions About Home Depot Financing

Here are some common questions people have about Home Depot’s interest-free financing:

Q: Can I use the card for non-Home Depot purchases?

A: Yes, the Home Depot Consumer Credit Card can be used at other retailers, but the interest-free offer only applies to purchases made at Home Depot.

Q: What happens if I miss a payment?

A: Missing a payment can result in penalties, including the loss of the interest-free offer. It’s important to stay on top of your payments to avoid any issues.

Q: Can I combine multiple purchases under one interest-free offer?

A: Yes, as long as all the purchases are made within the promotional period and meet the eligibility criteria.

Tips to Maximize Your Savings

Here are a few tips to help you make the most out of Home Depot’s interest-free financing:

- Create a detailed budget and repayment plan before making any purchases.

- Take advantage of any additional discounts or promotions offered by Home Depot during your shopping trip.

- Monitor your balance regularly and adjust your payments if needed to ensure you pay off the balance within 18 months.

Final Thoughts on Home Depot Interest-Free Financing

In conclusion, Home Depot’s interest-free 18-month financing can be a fantastic tool for making big home improvements or purchasing high-end appliances without the burden of immediate payment. However, it’s crucial to understand the terms, stick to your budget, and make timely payments to avoid any unexpected costs.

So, whether you’re revamping your kitchen, upgrading your appliances, or simply looking to enhance your living space, this offer can help you achieve your goals without breaking the bank. Just remember to play it smart and always keep an eye on the fine print.

Now that you’re armed with all the knowledge, go ahead and take advantage of this amazing deal. And don’t forget to share your experience in the comments below or check out our other articles for more money-saving tips!