Let’s talk about the Home Depot Credit Card Interest Free deal because this could be a game-changer for your next home improvement project. Whether you're remodeling your kitchen, updating your bathroom, or simply sprucing up your backyard, having a credit card that offers interest-free financing can save you a ton of money. But here's the thing – not everyone understands how it works, and that's where we come in. We're here to break it down for you in a way that’s easy to digest, so you can make the most out of this opportunity.

Now, I know what you're thinking. "Is it really interest-free?" or "What’s the catch?" Great questions! The Home Depot Credit Card Interest Free promotion is legit, but there are a few things you need to know before jumping in. In this guide, we’ll cover everything from how the interest-free period works to the fine print you should watch out for. Think of this as your cheat sheet to making smart financial decisions.

So, buckle up because we’re diving deep into the world of Home Depot credit cards, exploring the benefits, potential drawbacks, and tips to maximize your savings. By the end of this article, you’ll be equipped with all the knowledge you need to decide if this credit card is right for you. Let’s get started!

Read also:Inside The Imskirby Live Incident What Happened And Why It Matters

Table of Contents

- What is Home Depot Credit Card Interest Free?

- How Does the Interest-Free Period Work?

- Who is Eligible for the Interest-Free Offer?

- Benefits of the Home Depot Credit Card

- Potential Drawbacks to Consider

- Tips for Maximizing Your Savings

- Comparison with Other Retail Credit Cards

- Common Questions About Home Depot Credit Cards

- Expert Advice on Managing Credit Card Debt

- Final Thoughts and Next Steps

What is Home Depot Credit Card Interest Free?

Alright, let’s start with the basics. The Home Depot Credit Card Interest Free promotion is a feature offered by the Home Depot-branded credit card, which allows you to finance purchases without paying interest for a specific period. This is often referred to as a "deferred interest" program, meaning that as long as you pay off the balance within the promotional timeframe, you won’t be charged any interest.

Here’s the kicker: if you don’t pay off the full balance by the end of the promotional period, you’ll be hit with interest charges retroactively on the original purchase amount. So, it’s crucial to stay on top of your payments if you want to avoid any unexpected fees. We’ll dive deeper into this later, but for now, just remember – timing is everything.

Why Choose Home Depot Credit Card?

There are plenty of reasons why the Home Depot Credit Card stands out in the retail credit card world. First off, it’s specifically tailored for home improvement enthusiasts, offering perks like exclusive discounts, cashback rewards, and – you guessed it – interest-free financing on big-ticket items. If you’re planning a major project, this card could be your best friend.

How Does the Interest-Free Period Work?

Now, let’s talk about the nitty-gritty details of the interest-free period. When you sign up for the Home Depot Credit Card, you’ll typically get a promotional period ranging from 6 to 12 months, depending on the offer. During this time, you won’t be charged any interest on your purchases. Sounds awesome, right? Well, here’s the catch – you must pay off the full balance before the promotional period ends.

If you fail to pay off the balance, the deferred interest kicks in, and you’ll be charged interest on the entire original purchase amount, not just the remaining balance. That’s why it’s essential to create a payment plan and stick to it. Don’t let the interest-free period lull you into a false sense of security.

Key Points to Remember

- The interest-free period varies depending on the offer, so always check the terms and conditions.

- Pay off the full balance before the promotional period ends to avoid retroactive interest charges.

- Set up automatic payments or reminders to ensure you stay on track with your payments.

Who is Eligible for the Interest-Free Offer?

Not everyone can qualify for the Home Depot Credit Card Interest Free promotion. To be eligible, you’ll need to apply for the card and meet certain credit requirements. Typically, you’ll need a good or excellent credit score to qualify for the best offers. But don’t worry – even if you don’t have perfect credit, you might still be able to get approved for a lower-tier offer.

Read also:Maury Travis The Untold Story Of A Man Who Changed The Game

Here’s a quick breakdown of the eligibility criteria:

- Good credit score (usually 670 or above)

- Stable income to demonstrate your ability to repay

- No recent history of late payments or bankruptcies

Tips for Boosting Your Chances of Approval

If you’re worried about getting approved, here are a few tips to increase your chances:

- Check your credit report for errors and dispute any inaccuracies.

- Pay down existing debt to lower your credit utilization ratio.

- Consider adding a co-signer with better credit if necessary.

Benefits of the Home Depot Credit Card

Let’s talk about the good stuff – the benefits of using the Home Depot Credit Card. Besides the interest-free financing, there are plenty of perks that make this card worth considering:

Exclusive Discounts

Cardholders get access to exclusive discounts on Home Depot purchases, which can add up to significant savings over time. Whether you’re buying tools, appliances, or building materials, you’ll often find special deals that aren’t available to non-cardholders.

Cashback Rewards

Another great feature is the cashback rewards program. For every dollar you spend on your Home Depot Credit Card, you’ll earn points that can be redeemed for cashback or store credit. It’s like getting paid to shop – who doesn’t love that?

Flexible Payment Options

With multiple payment options, including online and mobile payments, managing your account has never been easier. You can even set up automatic payments to ensure you never miss a payment deadline.

Potential Drawbacks to Consider

While the Home Depot Credit Card offers plenty of benefits, there are a few potential drawbacks to keep in mind:

High Interest Rates After the Promotional Period

Once the interest-free period ends, the card’s standard APR kicks in, which can be pretty steep. If you’re unable to pay off the balance within the promotional timeframe, you could end up paying more in interest than you anticipated.

Strict Payment Requirements

As we mentioned earlier, failing to pay off the full balance by the end of the promotional period can result in retroactive interest charges. This can be a harsh penalty if you’re not careful.

Tips for Maximizing Your Savings

Now that you know the ins and outs of the Home Depot Credit Card Interest Free promotion, here are a few tips to help you make the most of it:

- Plan your purchases carefully and only use the card for items you can afford to pay off within the promotional period.

- Treat the interest-free period as a strict deadline and create a payment schedule to ensure you meet it.

- Take advantage of the exclusive discounts and cashback rewards to stretch your budget even further.

Comparison with Other Retail Credit Cards

How does the Home Depot Credit Card stack up against other retail credit cards? Let’s take a look:

Interest-Free Periods

Many retail credit cards offer interest-free financing, but the length of the promotional period can vary widely. Some cards offer as little as 6 months, while others may provide up to 18 months. The Home Depot Credit Card falls somewhere in the middle, typically offering 6 to 12 months.

Rewards Programs

When it comes to rewards, the Home Depot Credit Card stands out with its cashback program and exclusive discounts. However, other cards may offer different types of rewards, such as travel points or gift cards, depending on your preferences.

Common Questions About Home Depot Credit Cards

Here are some frequently asked questions about the Home Depot Credit Card:

Can I Use the Card at Other Stores?

No, the Home Depot Credit Card is specifically designed for use at Home Depot locations and on their website. However, you can use it for both in-store and online purchases.

What Happens If I Miss a Payment?

Missing a payment can result in late fees and may also impact your credit score. Additionally, if you fail to pay off the full balance by the end of the promotional period, you’ll be charged interest retroactively on the original purchase amount.

Expert Advice on Managing Credit Card Debt

Managing credit card debt can be tricky, but with the right strategies, you can stay on top of your finances. Here are a few expert tips:

- Always pay more than the minimum payment to reduce your balance faster.

- Consider consolidating multiple credit card balances into one lower-interest loan if needed.

- Monitor your credit score regularly to ensure you’re on the right track.

Final Thoughts and Next Steps

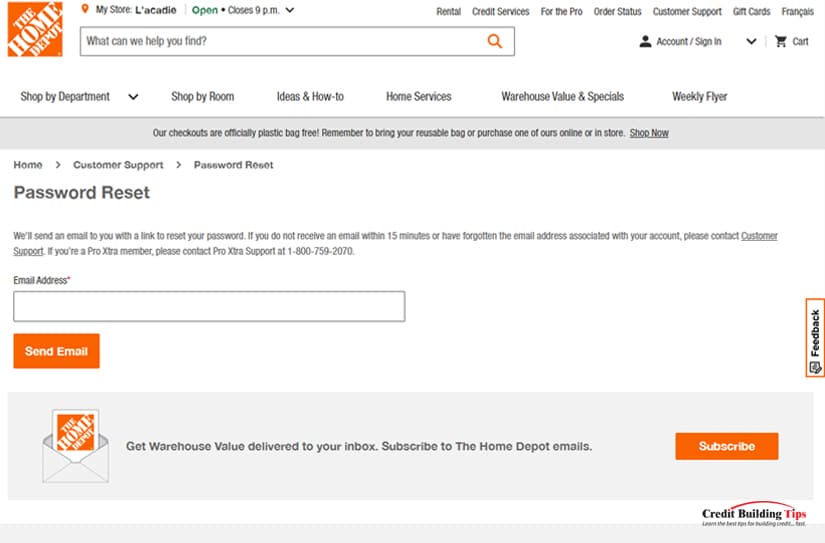

Alright, that’s a wrap on our ultimate guide to the Home Depot Credit Card Interest Free promotion. By now, you should have a solid understanding of how it works, the benefits and drawbacks, and how to make the most of it. Remember, the key to success with this card is staying disciplined and sticking to your payment plan.

So, what’s next? If you’re ready to take advantage of this offer, head over to the Home Depot website and apply for the card today. And don’t forget to share this article with your friends and family who might benefit from the information. Together, let’s make smart financial decisions and turn those home improvement dreams into reality!