Let’s cut right to the chase, folks. If you've ever thought about sprucing up your home or tackling those long-overdue renovations, the Home Depot Card with zero interest can be your golden ticket to making it happen without breaking the bank. Whether you're replacing that creaky old roof or giving your kitchen a sleek new look, this financing option can save you big time. So, buckle up because we're diving deep into everything you need to know about the Home Depot Card and its zero-interest deals.

Now, I get it. Credit cards and financing options can sometimes feel like navigating a labyrinth of fine print and hidden fees. But don’t sweat it. In this guide, we’ll break it all down for you in plain, easy-to-understand terms. From how the zero-interest period works to potential pitfalls you should watch out for, we’ve got your back.

So, whether you’re a seasoned homeowner or just starting out, stick around. By the end of this article, you’ll have all the tools you need to decide if the Home Depot Card is the right fit for your next project. Let’s roll!

Read also:Brandon Burlsworth Accident Who Was At Fault The Untold Story

Why Home Depot Card Zero Interest is a Game Changer

Let’s face it, home improvement projects aren’t exactly cheap. Between materials, labor, and unexpected expenses, the costs can add up faster than you can say "power drill." That's where the Home Depot Card with zero interest comes in. It’s like having a financial sidekick that helps you tackle those big-ticket items without the immediate financial strain.

Here’s the kicker: during the zero-interest period, you won’t pay a dime in interest on eligible purchases. This means you can spread out your payments over several months without worrying about extra charges creeping in. But remember, there’s a catch. If you don’t pay off the balance before the promotional period ends, you’ll be hit with retroactive interest on the original purchase amount. So, it’s crucial to have a solid plan in place to pay it off on time.

Understanding the Basics of Home Depot Card

How Does the Zero-Interest Promotion Work?

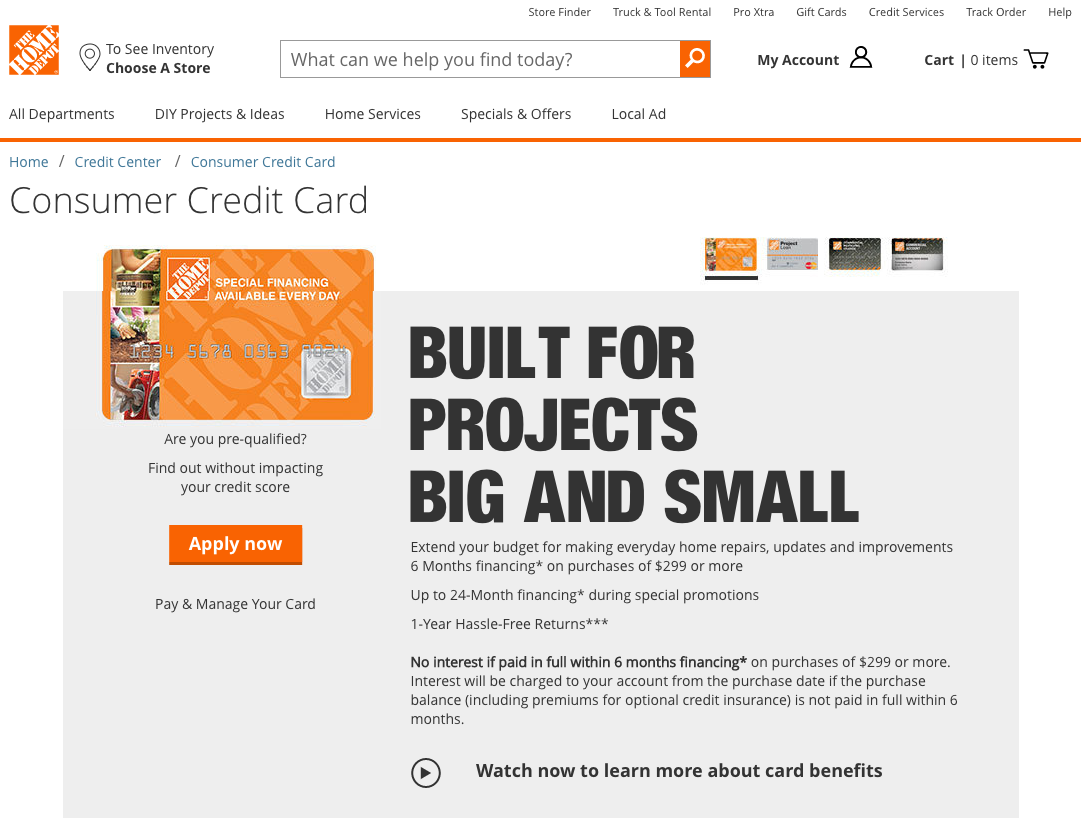

Alright, let’s break it down. When you sign up for the Home Depot Credit Card, you’ll often qualify for a special promotional period where you won’t be charged any interest on certain purchases. This period typically lasts anywhere from 6 to 24 months, depending on the offer. During this time, you can make monthly payments toward your balance without worrying about interest piling up.

But here’s the thing: you’ve got to pay off the full balance before the promo period ends. If you don’t, you’ll be charged interest retroactively on the entire purchase amount. So, while the zero-interest deal sounds amazing—and it is—you’ve gotta stay on top of your payments to truly take advantage of it.

Eligible Purchases for Zero Interest

Not every purchase you make with the Home Depot Card will qualify for the zero-interest promotion. Generally, larger purchases like appliances, flooring, or major renovation materials are eligible. Smaller items, like paintbrushes or screws, might not cut it. Always double-check the terms of your specific offer to see what’s included.

Pro tip: If you’re planning a big project, consider bundling your purchases to maximize the zero-interest benefit. For example, if you’re redoing your bathroom, buy the sink, tiles, and fixtures all at once to ensure they fall under the same promotional period.

Read also:Lacey Fletcher Sofa The Ultimate Guide To Style Comfort And Quality

How to Apply for the Home Depot Card

Step-by-Step Guide to Getting Approved

Applying for the Home Depot Card is pretty straightforward. You can do it in-store or online, whichever suits you best. Here’s how it goes:

- Step 1: Visit a Home Depot store or head to their website.

- Step 2: Fill out the application form with your personal and financial information.

- Step 3: Wait for the approval process, which usually takes just a few minutes.

- Step 4: If approved, you’ll receive your card and details about the zero-interest promotion.

Oh, and one more thing. Your credit score plays a big role in whether you’ll get approved and what kind of terms you’ll receive. So, it’s always a good idea to check your credit report beforehand to ensure everything’s in tip-top shape.

Benefits of Using the Home Depot Card

Aside from the zero-interest promotion, there are plenty of other perks to using the Home Depot Card. For starters, you’ll earn rewards points on your purchases, which you can redeem for discounts on future buys. Plus, you’ll get access to exclusive sales and offers that aren’t available to regular customers.

And let’s not forget about the convenience factor. Having a dedicated card for your home improvement needs makes budgeting and tracking expenses a whole lot easier. Plus, it’s one less card to carry around for everyday purchases.

Potential Downsides to Watch Out For

While the Home Depot Card offers some fantastic benefits, there are a few downsides to keep in mind. First off, if you don’t pay off your balance during the zero-interest period, you’ll face some pretty steep interest rates. As of 2023, the APR on the card can range from 24.99% to 29.99%. Yikes, right?

Additionally, the card doesn’t offer much in the way of flexibility. It’s specifically designed for Home Depot purchases, so you won’t be able to use it elsewhere. And if you’re not careful, those rewards points can expire before you have a chance to use them.

Tips for Maximizing Your Zero-Interest Period

Create a Payment Plan

The key to making the most of your zero-interest promotion is to have a solid payment plan in place. Start by calculating how much you’ll need to pay each month to clear the balance before the promo period ends. Then, set up automatic payments to ensure you never miss a beat.

Another smart move is to keep track of your spending. It’s easy to get carried away when you’re not paying interest, but staying within your budget will help you avoid any nasty surprises down the road.

Common Mistakes to Avoid

Even the best-laid plans can go awry if you’re not careful. Here are a few common mistakes people make when using the Home Depot Card:

- Ignoring the Fine Print: Always read the terms and conditions of your card agreement to fully understand the zero-interest offer.

- Missing Payments: Even one missed payment can mess up your credit score and lead to penalties.

- Overextending Yourself: Just because you can afford the monthly payments doesn’t mean you should take on more debt than you can handle.

Alternatives to Home Depot Card

If the Home Depot Card isn’t the right fit for you, there are plenty of other financing options out there. Many home improvement stores offer similar zero-interest promotions, so it’s worth shopping around to see what else is available. You could also consider personal loans or home equity lines of credit, depending on your financial situation.

Whatever route you choose, make sure it aligns with your long-term financial goals and won’t leave you drowning in debt.

Final Thoughts: Is the Home Depot Card Right for You?

So, there you have it. The Home Depot Card with zero interest can be an incredible tool for tackling those big home improvement projects without the immediate financial burden. But, like any financial product, it comes with its own set of pros and cons.

If you’re disciplined with your payments and stay within your budget, the card can save you a ton of money. However, if you’re not careful, it could end up costing you more in the long run. So, take some time to weigh the options and decide if it’s the right choice for your situation.

And hey, don’t forget to share this article with your friends and family who might be considering the Home Depot Card. Knowledge is power, and the more people know about these financing options, the better decisions they can make. Thanks for sticking around, and happy renovating!

Table of Contents

- Why Home Depot Card Zero Interest is a Game Changer

- Understanding the Basics of Home Depot Card

- How Does the Zero-Interest Promotion Work?

- Eligible Purchases for Zero Interest

- How to Apply for the Home Depot Card

- Step-by-Step Guide to Getting Approved

- Benefits of Using the Home Depot Card

- Potential Downsides to Watch Out For

- Tips for Maximizing Your Zero-Interest Period

- Common Mistakes to Avoid

- Alternatives to Home Depot Card