Ever wondered what that "24 months" offer at Home Depot really means for your wallet? Well, buckle up, because we're diving deep into the world of Home Depot financing, deals, and how you can make smart choices without breaking the bank. Whether you're remodeling your kitchen, building a dream backyard, or just need some tools, understanding the ins and outs of Home Depot's 24-month financing options is a game-changer.

Let's face it, home improvement projects can get pricey real quick. But here's the good news—Home Depot offers a range of financing options, especially that tempting "24 months same as cash" deal. It sounds too good to be true, right? Not if you know how to navigate it properly. In this article, we'll break down everything you need to know about Home Depot's financing plans, including the pros, cons, and tips to maximize your savings.

From understanding interest rates to finding the best deals on appliances and tools, this guide will equip you with the knowledge you need to make informed decisions. Whether you're a seasoned DIYer or just starting out, we've got you covered. So, let's jump in and explore the world of Home Depot 24 months financing!

Read also:Stl Mugshots Your Ultimate Guide To Understanding St Louis Police Records

What is Home Depot 24 Months Financing?

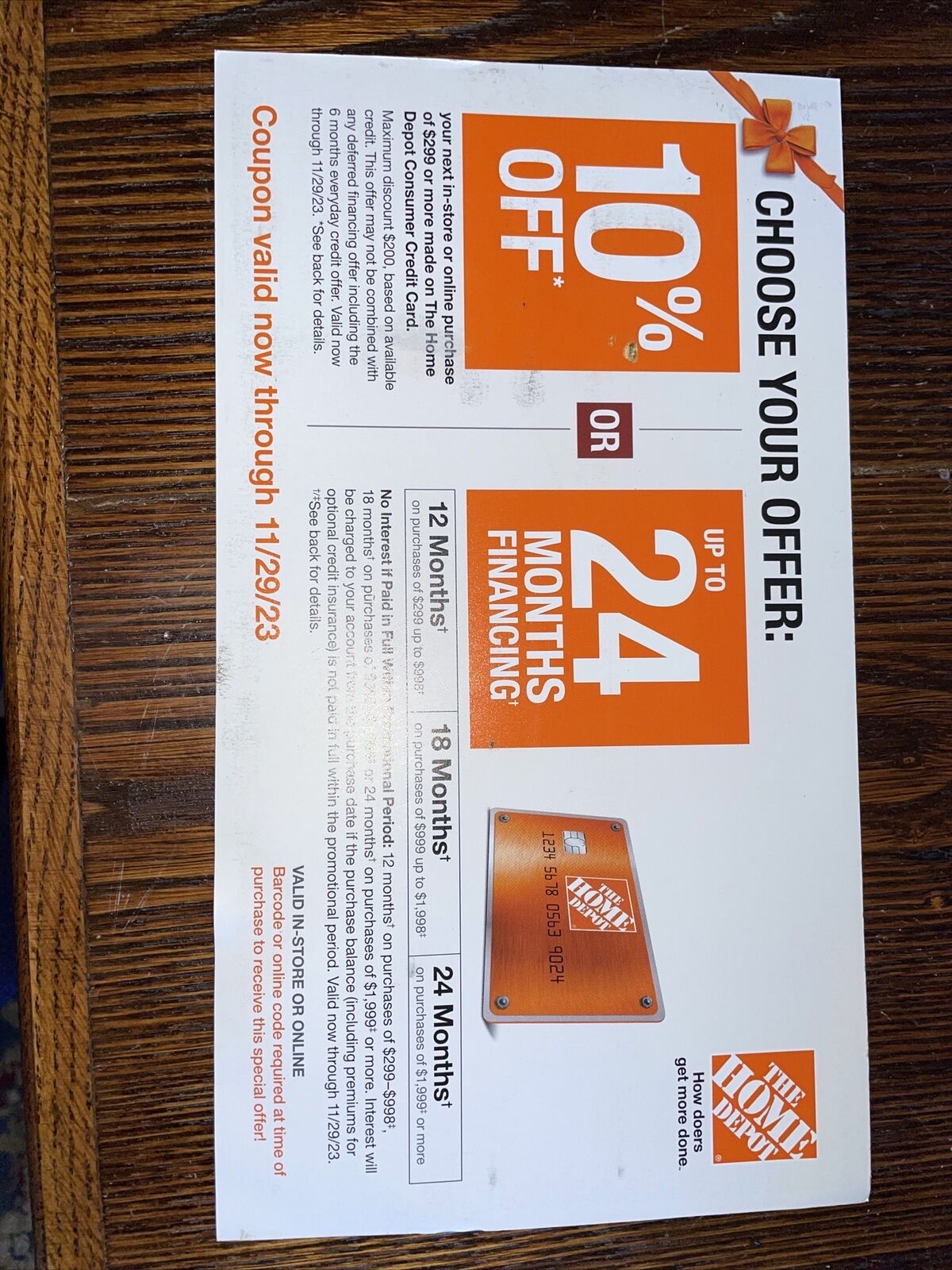

First things first, let's clarify what we're talking about here. Home Depot's "24 months same as cash" financing is essentially a deferred interest program. What does that mean? Simply put, if you pay off your purchase within the 24-month period, you won't have to pay any interest. But—and this is a big but—if you don't pay it off in full, you'll be charged interest retroactively from the date of purchase.

This option is available on purchases made with the Home Depot Credit Card or the Home Depot Consumer Credit Card. It's like a short-term loan with a twist—if you manage your payments wisely, you can save a ton of money. But if you miss the deadline, those interest charges can add up fast. So, it's crucial to plan your payments accordingly.

How Does the 24 Months Same as Cash Work?

Alright, so you've decided to take advantage of Home Depot's 24 months offer. Now, let's break down how it works. When you sign up for the financing plan, you'll get a set period—usually 24 months—to pay off your purchase without any interest. During this time, you'll make regular monthly payments based on the amount you owe.

Here's the catch: if you don't pay off the full balance by the end of the 24 months, you'll be charged interest on the entire purchase amount from day one. That's why it's super important to calculate your payments and stick to a budget. Here's a quick rundown of the key points:

- No interest if paid in full within 24 months

- Available on purchases over a certain amount (usually $299 or more)

- Requires a Home Depot Credit Card or Consumer Credit Card

- Interest rates can be high if not paid off in time

Benefits of Using Home Depot 24 Months Financing

Now that we understand how it works, let's talk about the benefits. The biggest advantage of Home Depot's 24 months financing is the ability to spread out large purchases over time without incurring interest. This can be a lifesaver for big projects like kitchen renovations, bathroom upgrades, or even buying a new set of appliances.

Here are some of the top benefits:

Read also:Julie Green Rumble The Queen Of Heartfelt Melodies

- Zero Interest for 24 Months: If you pay off the balance within the promotional period, you won't pay a penny in interest.

- Flexibility: You can make smaller monthly payments instead of paying the full amount upfront, which can ease the financial burden.

- Big Ticket Items: Ideal for purchasing expensive items like appliances, furniture, or power tools without having to pay everything at once.

- Exclusive Discounts: Cardholders often get access to special promotions and discounts that aren't available to regular customers.

Potential Downsides to Watch Out For

While the benefits are tempting, it's important to be aware of the potential downsides. The biggest risk with deferred interest plans is the possibility of retroactive interest charges. If you miss the deadline, even by a little, you could end up paying a lot more than you anticipated.

Other things to consider include:

- High Interest Rates: If you don't pay off the balance within 24 months, the interest rate can be quite steep, often around 24-29%.

- Credit Impact: Applying for a new credit card or financing plan can temporarily lower your credit score, and missing payments can have long-term effects.

- Eligibility Requirements: Not everyone qualifies for the financing plan, and you may need a good credit score to get approved.

How to Qualify for Home Depot 24 Months Financing

Qualifying for Home Depot's 24 months financing is relatively straightforward, but there are a few things to keep in mind. First, you'll need to apply for either the Home Depot Credit Card or the Home Depot Consumer Credit Card. Approval typically depends on your credit score, credit history, and income.

Here's a quick guide to help you increase your chances of getting approved:

- Maintain a Good Credit Score: Aim for a score of at least 680 or higher for the best chances of approval.

- Provide Accurate Information: Be honest about your income and employment status when applying.

- Review Your Credit Report: Check for any errors or discrepancies that could affect your application.

Steps to Apply for Home Depot Financing

Applying for Home Depot financing is easy and can be done online or in-store. Here's how:

- Visit the Home Depot website or go to your local store.

- Fill out the application form, providing your personal and financial information.

- Wait for approval, which usually takes just a few minutes.

- Once approved, you can start using your new card for eligible purchases.

Maximizing Your Savings with Home Depot 24 Months Financing

Now that you know how to qualify and apply, let's talk about how to maximize your savings. The key to making the most of Home Depot's financing plan is to plan ahead and stick to your budget. Here are some tips to help you save big:

- Set Up Automatic Payments: This ensures you never miss a payment and stay on track to pay off the balance within 24 months.

- Track Your Spending: Keep a close eye on your purchases and make sure you don't overspend.

- Take Advantage of Discounts: Look for additional promotions or coupons that can further reduce your costs.

Common Mistakes to Avoid

Even with the best intentions, it's easy to make mistakes when using deferred interest plans. Here are some common pitfalls to watch out for:

- Underestimating Monthly Payments: Make sure you calculate how much you need to pay each month to avoid interest charges.

- Ignoring Due Dates: Late payments can lead to interest charges and damage your credit score.

- Overextending Yourself: Don't take on more debt than you can handle just because the financing seems appealing.

Home Depot 24 Months Financing vs Other Options

When it comes to financing home improvement projects, Home Depot's 24 months offer is just one of many options. Let's compare it to other popular choices:

- Personal Loans: These typically have lower interest rates than credit cards but require a lump sum payment upfront.

- Home Equity Loans: Great for larger projects, but they require home ownership and can take longer to process.

- Cashback Credit Cards: Some cards offer cashback rewards, but the interest rates can be higher than Home Depot's plan.

Which Option is Right for You?

The best choice depends on your financial situation and the size of your project. If you're confident you can pay off the balance within 24 months, Home Depot's financing plan is a great option. But if you need more time or prefer lower interest rates, a personal loan or home equity loan might be a better fit.

Real-Life Success Stories

Let's hear from some real people who have used Home Depot's 24 months financing and how it worked for them. Sarah, a homeowner from Texas, used the plan to finance her kitchen renovation and saved thousands in interest by paying off the balance on time. Meanwhile, John from California used it to buy a new set of power tools for his contracting business, allowing him to expand his operations without dipping into savings.

Lessons Learned from Real Users

One common theme among successful users is the importance of planning. Whether it's setting up a budget, automating payments, or keeping track of due dates, staying organized is key to making the most of Home Depot's financing options.

Conclusion: Make the Most of Home Depot 24 Months Financing

In conclusion, Home Depot's 24 months financing is a powerful tool for anyone looking to tackle home improvement projects without breaking the bank. By understanding how it works, qualifying for the plan, and planning your payments carefully, you can save big on interest and spread out your costs over time.

So, whether you're remodeling your home, upgrading your tools, or just making a few updates, don't miss out on this opportunity. And remember, if you have any questions or need further advice, feel free to drop a comment below or share this article with your friends and family. Together, let's make smart financial decisions and turn our homes into the spaces we've always dreamed of!

Table of Contents

- What is Home Depot 24 Months Financing?

- How Does the 24 Months Same as Cash Work?

- Benefits of Using Home Depot 24 Months Financing

- Potential Downsides to Watch Out For

- How to Qualify for Home Depot 24 Months Financing

- Steps to Apply for Home Depot Financing

- Maximizing Your Savings with Home Depot 24 Months Financing

- Common Mistakes to Avoid

- Home Depot 24 Months Financing vs Other Options

- Real-Life Success Stories