So, listen up, folks! If you've been keeping tabs on home improvement deals or planning that dream renovation, you might have stumbled across the term "home depot 2 years no interest." It’s a game-changer for anyone looking to upgrade their space without breaking the bank right away. But here's the thing—there’s more to it than just those shiny headlines. Let me break it down for you in a way that’s easy to digest and helps you make smarter decisions. Stick around, because this is gonna be good!

Now, before we dive deep into the nitty-gritty, let’s address why this offer matters. Imagine this: you’re renovating your kitchen or upgrading your outdoor living space, but the upfront costs seem daunting. Enter Home Depot’s 2-year no-interest financing. This means you can spread out the cost of your purchases over two years without paying any interest—as long as you pay off the balance within that timeframe. Sounds too good to be true? Well, there’s always fine print, and we’re about to decode it for you.

Whether you’re a seasoned homeowner or just starting out, understanding how financing options like this work can save you thousands in the long run. So buckle up, because we’re about to walk you through everything you need to know to take full advantage of this deal. From eligibility requirements to tips for maximizing your savings, we’ve got you covered.

Read also:Kyle Cheney And Liz Cheney The Family Connection You Need To Know

What is Home Depot 2 Years No Interest?

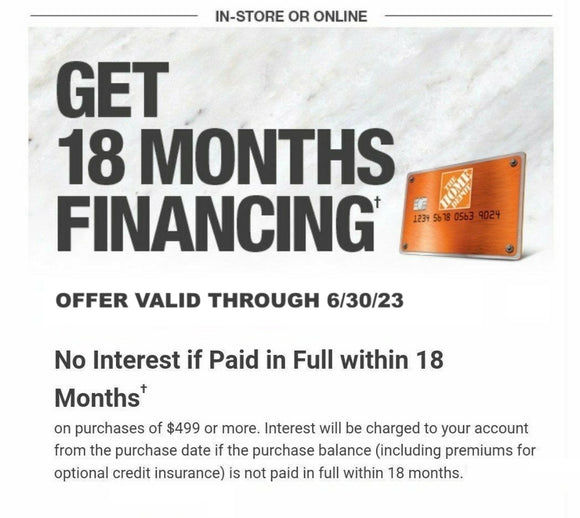

Alright, let’s get real here. The "home depot 2 years no interest" offer is essentially a financing option that allows you to purchase big-ticket items—like appliances, furniture, or building materials—without accruing interest for 24 months. Think of it as a grace period where you can pay off your balance without the added burden of interest charges. However, there’s a catch: if you don’t pay off the full amount within the promotional period, you’ll be hit with retroactive interest charges from the date of purchase.

This deal is typically available through Home Depot’s credit card program, which offers perks like special financing, discounts, and cashback rewards. But here’s the kicker—it’s not just about the no-interest period. The card also gives you access to other exclusive offers, making it a valuable tool for anyone serious about home improvement projects.

How Does It Work?

Let’s break it down step by step, because understanding the mechanics of this offer is crucial if you want to avoid any unpleasant surprises later on.

- First, you apply for a Home Depot credit card. Approval is usually quick, and you’ll get notified right away whether you’re eligible for the financing offer.

- Once approved, you can start shopping for eligible items. These could range from kitchen cabinets to lawnmowers, depending on the specific promotion.

- During the 2-year period, you’ll need to make minimum monthly payments. This keeps your account active and ensures you stay on track to pay off the balance.

- If you pay off the entire balance within 24 months, you avoid paying any interest. But if you miss the deadline, you’ll owe interest on the original purchase price from day one.

It’s a pretty straightforward process, but the devil is in the details. Make sure you read the fine print carefully and plan your payments accordingly to avoid any unexpected fees.

Eligibility Requirements

Not everyone qualifies for the "home depot 2 years no interest" deal, so it’s important to know what the requirements are. Generally, you’ll need:

- A decent credit score—usually around 650 or higher.

- A stable income to demonstrate your ability to repay the balance.

- No history of late payments or defaults on other credit accounts.

Keep in mind that credit requirements may vary depending on the specific promotion, so it’s always a good idea to check with Home Depot directly for the most accurate information.

Read also:Poop Smells Like Weed Why It Happens And What You Can Do About It

Benefits of Using Home Depot Financing

So, why should you consider using Home Depot’s 2-year no-interest financing? Here are a few compelling reasons:

- Spread out payments: Instead of paying a lump sum upfront, you can break down the cost into manageable monthly payments.

- Interest-free period: As long as you pay off the balance within 24 months, you won’t owe a single cent in interest.

- Exclusive discounts: Cardholders often get access to special promotions and discounts that aren’t available to regular shoppers.

- Build credit: Responsible use of the Home Depot credit card can help improve your credit score over time.

These benefits make the financing option particularly attractive for large purchases where the upfront cost might be prohibitive.

Common Misconceptions About Home Depot Financing

There are a few myths floating around about Home Depot’s 2-year no-interest deal, and it’s important to set the record straight. Here are some of the most common misconceptions:

- Myth #1: You have to spend a certain amount to qualify. Reality: There’s no minimum spend requirement to take advantage of the financing offer.

- Myth #2: It’s only for appliances. Reality: The offer applies to a wide range of products, including tools, materials, and fixtures.

- Myth #3: Missing one payment won’t affect you. Reality: Even a single missed payment can result in retroactive interest charges, so stay vigilant.

Knowing the facts can help you make better-informed decisions and avoid costly mistakes.

Tips for Maximizing Your Savings

Now that you understand how the "home depot 2 years no interest" deal works, here are some tips to help you get the most out of it:

- Plan your purchases: Make a list of the items you need and stick to it to avoid impulse buys.

- Create a budget: Calculate how much you’ll need to pay each month to clear the balance within 24 months.

- Set up automatic payments: This ensures you never miss a payment and avoid any late fees.

- Monitor your account: Keep an eye on your balance and make extra payments whenever possible to reduce the total amount owed.

By following these tips, you can maximize your savings and avoid any unnecessary expenses.

What Happens If You Don’t Pay Off the Balance?

This is a crucial question, so let’s address it head-on. If you don’t pay off the full balance within the 2-year period, you’ll be charged interest on the original purchase price from the date of purchase. This can add up quickly, so it’s important to plan ahead and make sure you can meet the deadline.

Some people assume that they’ll only owe interest on the remaining balance, but that’s not the case. The interest is calculated retroactively, meaning you could end up paying significantly more than you anticipated. To avoid this, always aim to pay off the balance in full before the promotional period ends.

Alternatives to Home Depot Financing

While the "home depot 2 years no interest" deal is a great option for many, it’s not the only game in town. Here are a few alternatives to consider:

- Personal loans: If you have a good credit score, you might qualify for a personal loan with a lower interest rate than a credit card.

- 0% APR credit cards: Some credit cards offer introductory 0% APR periods that can last up to 18 months.

- Cashback rewards: If you don’t need the extended financing period, a cashback credit card could help you earn rewards on your purchases.

Each option has its pros and cons, so it’s important to weigh your choices carefully before committing to one.

Real-Life Success Stories

Let’s hear from some real people who’ve used the "home depot 2 years no interest" deal to their advantage:

John from Ohio used the financing option to renovate his bathroom. By spreading out the cost over 24 months, he was able to upgrade his fixtures and tiles without straining his budget. “It was a lifesaver,” he says. “I couldn’t have done it without the no-interest deal.”

Sarah from California took a similar approach when she bought a new set of power tools for her DIY projects. “I knew I could afford the monthly payments, so it made sense to take advantage of the offer,” she explains. “And the cashback rewards were just icing on the cake.”

These stories show that with careful planning and responsible use, Home Depot’s financing options can be a powerful tool for achieving your home improvement goals.

How to Apply for Home Depot Financing

Ready to sign up? Here’s how you can apply for the "home depot 2 years no interest" deal:

- Visit a Home Depot store or go to their website.

- Fill out the application form, either online or in-store.

- Provide your personal and financial information as requested.

- Wait for instant approval and start shopping!

The process is quick and straightforward, but remember to review the terms and conditions carefully before submitting your application.

Conclusion

In summary, the "home depot 2 years no interest" deal is a fantastic opportunity for anyone looking to upgrade their home without the immediate financial burden. By understanding how it works, planning your payments, and staying on top of your account, you can save thousands and achieve your renovation goals.

So, what are you waiting for? Head over to Home Depot and start exploring the possibilities. And don’t forget to share this article with your friends and family—knowledge is power, and the more people who know about this deal, the better!

Table of Contents

- What is Home Depot 2 Years No Interest?

- How Does It Work?

- Eligibility Requirements

- Benefits of Using Home Depot Financing

- Common Misconceptions About Home Depot Financing

- Tips for Maximizing Your Savings

- What Happens If You Don’t Pay Off the Balance?

- Alternatives to Home Depot Financing

- Real-Life Success Stories

- How to Apply for Home Depot Financing