Shopping for home improvement projects can be a blast, but it can also hit your wallet hard. Luckily, Home Depot offers a 18 months no interest credit card that could be your secret weapon to save some serious cash. Whether you're renovating your kitchen, updating your bathroom, or just sprucing up the garden, this card has got your back. But hey, before you jump in, let's break down the details so you're fully equipped to make the most out of it.

Imagine walking into Home Depot with a plan to upgrade your living space. You’ve got your dream furniture, tools, and appliances in mind. But then, the price tags start to add up. That’s where the Home Depot 18 months no interest credit card comes in. It’s like having a financial buddy who lets you pay later without any interest – as long as you stick to the rules.

Now, don’t get me wrong. This isn’t just another credit card. It’s a strategic tool that can help you manage your finances while you’re busy transforming your home. But like any financial product, it’s important to understand how it works and what’s expected of you. Let’s dive deep into the world of Home Depot’s no-interest card and see how it can benefit you.

Read also:Keith Conan Richter Released The Untold Story You Wont Believe

What Exactly is the Home Depot 18 Months No Interest Credit Card?

The Home Depot 18 months no interest credit card is more than just a piece of plastic. It’s a specialized financing option designed to help you tackle those big-ticket home improvement projects without breaking the bank. Here’s the deal: when you purchase eligible items, you can enjoy 18 months of interest-free payments. That means you have almost a year and a half to pay off your balance without any extra charges.

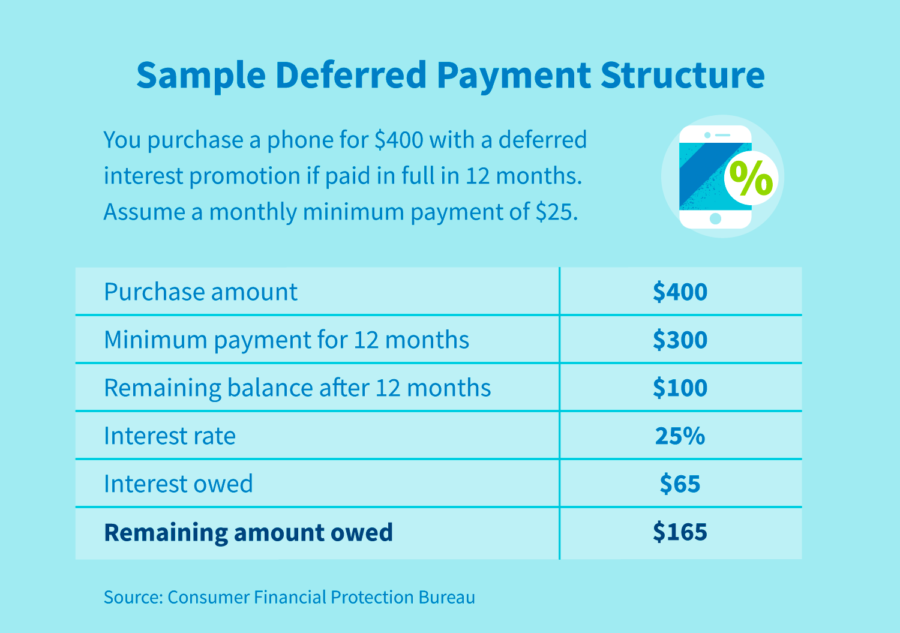

But wait, there’s a catch. If you don’t pay off the full balance within the 18-month period, you’ll be hit with retroactive interest on the original purchase amount. So, it’s crucial to plan your payments carefully. The card is issued by Citibank, which means it comes with all the perks and protections you’d expect from a major credit card issuer.

Why Should You Choose Home Depot's No Interest Credit Card?

Choosing the right financing option for your home improvement projects can make all the difference. Here’s why the Home Depot 18 months no interest credit card might be the perfect fit for you:

- No Interest for 18 Months: This gives you ample time to pay off your balance without worrying about extra charges.

- Big Purchases Made Easy: Whether it’s a new fridge, a set of power tools, or a complete kitchen remodel, this card makes it easier to spread out the cost.

- Exclusive Discounts: As a cardholder, you’ll often get access to special promotions and discounts at Home Depot stores.

- No Annual Fee: You won’t have to pay an annual fee just to carry the card, which is a win-win for your wallet.

How Does the 18 Months No Interest Period Work?

Here’s the lowdown on how the 18 months no interest period works. When you make a purchase with the Home Depot credit card, you’ll have 18 months to pay it off without any interest accruing. However, you must make the minimum monthly payments to keep the interest-free period active. If you miss a payment or don’t pay off the full balance by the end of the 18 months, you’ll be charged interest on the entire original purchase amount.

What Happens If You Don’t Pay Off the Balance in Time?

If you don’t manage to pay off the balance within the 18-month period, you’ll be hit with retroactive interest. This means you’ll be charged interest on the original purchase amount from day one. It’s like getting a surprise bill you didn’t expect. That’s why it’s super important to plan your payments and stick to a budget.

Eligibility Requirements for the Home Depot Credit Card

Not everyone can qualify for the Home Depot 18 months no interest credit card. Here’s what you need to know about eligibility:

Read also:Unlocking The Secrets Of Fbsm Nyc Your Ultimate Guide To New Yorks Trendiest Scene

- Good Credit Score: You’ll need a decent credit score to qualify. While there’s no specific number, having a score in the mid-600s or higher will increase your chances.

- Stable Income: Lenders want to see that you have a reliable source of income to ensure you can make the payments.

- Residency: You must be a U.S. resident to apply for the card.

Remember, even if you don’t qualify right now, you can always work on improving your credit score and reapply later.

Steps to Apply for the Home Depot Credit Card

Applying for the Home Depot 18 months no interest credit card is pretty straightforward. Here’s how you can do it:

- Visit the Home Depot Website: Head over to Home Depot’s official site and navigate to the credit card section.

- Fill Out the Application: Complete the online application form with your personal and financial details.

- Submit Your Application: Once you’ve filled out the form, submit it and wait for a decision. Approval is usually pretty quick.

Pro tip: If you’re planning a big purchase, apply for the card before you hit the checkout counter. That way, you can ensure your purchase qualifies for the 18 months no interest period.

Benefits of Using the Home Depot Credit Card

There are plenty of perks to using the Home Depot 18 months no interest credit card. Let’s take a closer look:

- No Interest for 18 Months: This gives you the flexibility to pay off large purchases over time without additional charges.

- Special Promotions: Cardholders often get access to exclusive deals and discounts at Home Depot stores.

- No Annual Fee: You won’t have to pay an annual fee just to carry the card.

- Convenience: Having a dedicated card for home improvement projects makes budgeting and tracking expenses easier.

Are There Any Hidden Fees?

While the card itself doesn’t come with an annual fee, there are a few things to watch out for. Late payment fees can add up quickly, so make sure you always pay on time. Additionally, if you don’t pay off the balance within the 18 months, you’ll be charged retroactive interest. Always read the fine print to avoid any surprises.

How to Maximize Your Savings with the Home Depot Credit Card

Here are a few tips to help you make the most of your Home Depot 18 months no interest credit card:

- Create a Payment Plan: Divide the total purchase amount by 18 to figure out how much you need to pay each month to avoid interest.

- Track Your Spending: Keep an eye on your purchases to ensure you don’t overspend.

- Take Advantage of Promotions: Look out for special offers and discounts available to cardholders.

- Pay More Than the Minimum: If you can afford it, paying more than the minimum each month will help you pay off the balance faster.

What Happens After the 18 Months?

After the 18 months no interest period ends, the card will revert to its standard interest rate. This can be anywhere from 24.99% to 29.99%, depending on your creditworthiness. If you still have a balance on the card, you’ll start accruing interest on any remaining amount.

Common Questions About the Home Depot Credit Card

Q: Can I Use the Card Outside of Home Depot?

A: The Home Depot credit card is primarily designed for use at Home Depot stores and online. However, some versions of the card may allow you to use it elsewhere, so check the terms and conditions.

Q: What Happens If I Miss a Payment?

A: If you miss a payment, you’ll be charged a late fee, and it could affect your eligibility for the 18 months no interest period. Always aim to pay on time to avoid any issues.

Q: Can I Combine Multiple Purchases Under the 18 Months No Interest Plan?

A: Yes, you can combine multiple purchases under the same plan as long as they qualify. Just make sure to pay off the full balance within the 18 months to avoid interest.

Conclusion: Is the Home Depot 18 Months No Interest Credit Card Right for You?

Wrapping it up, the Home Depot 18 months no interest credit card is a fantastic option for anyone looking to finance home improvement projects without breaking the bank. With no interest for 18 months, exclusive discounts, and no annual fee, it offers plenty of value. However, it’s important to use it responsibly and pay off the balance within the interest-free period to avoid any unexpected charges.

So, if you’re ready to upgrade your home and save some cash, consider applying for the Home Depot credit card. And remember, always read the fine print and plan your payments carefully. Now that you know the ins and outs, it’s time to take action. Share this article with your friends, leave a comment below, or check out our other guides for more tips on managing your finances.

Table of Contents

What Exactly is the Home Depot 18 Months No Interest Credit Card?

Why Should You Choose Home Depot's No Interest Credit Card?

How Does the 18 Months No Interest Period Work?

Eligibility Requirements for the Home Depot Credit Card

Steps to Apply for the Home Depot Credit Card

Benefits of Using the Home Depot Credit Card

How to Maximize Your Savings with the Home Depot Credit Card

Common Questions About the Home Depot Credit Card

Conclusion: Is the Home Depot 18 Months No Interest Credit Card Right for You?