Are you tired of overpaying for insurance? Let's face it, life’s expensive enough without throwing your hard-earned cash at inflated premiums. If you're looking to get GEICO insurance quote, you're in the right place. This guide will walk you through everything you need to know about GEICO and how to secure the best deal possible. So grab a cup of coffee, sit back, and let’s dive in!

Insurance is one of those things we all need but rarely enjoy paying for. Whether it's car insurance, home insurance, or even pet insurance, finding the right coverage at the right price can feel like a never-ending headache. That's where GEICO comes in. GEICO has been around for decades, and they're known for offering affordable, reliable policies that actually make sense.

But here's the deal: getting the best GEICO insurance quote isn’t just about typing a few details into a form. It’s about knowing what to look for, understanding the factors that affect your premium, and making smart decisions along the way. In this guide, we'll break it all down for you so you can save big while staying protected.

Read also:John Olsson Net Worth The Untold Story Of A Financial Titan

Here’s a quick table of contents to help you navigate:

- What is GEICO?

- Why Choose GEICO?

- How to Get a GEICO Insurance Quote

- Factors Affecting Your GEICO Insurance Price

- Types of Insurance GEICO Offers

- Tips for Saving on GEICO Insurance

- Common Questions About GEICO Quotes

- Customer Experience with GEICO

- Comparison with Other Insurance Providers

- Final Thoughts

What is GEICO?

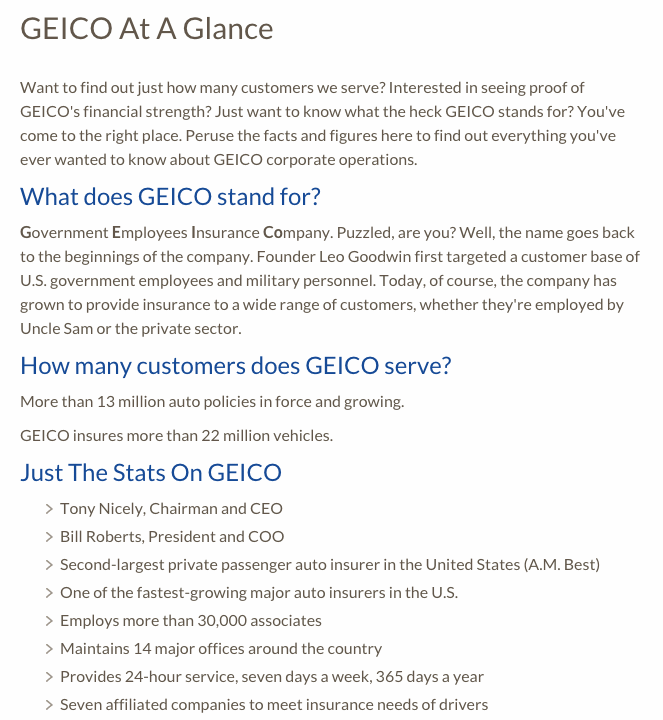

GEICO stands for Government Employees Insurance Company, but don't let the name fool ya. They're not just for government employees anymore. Founded way back in 1936, GEICO has grown into one of the largest auto insurance providers in the U.S., serving millions of customers across the country.

History of GEICO

Back in the day, GEICO was created to provide affordable insurance options specifically for government employees. Fast forward to today, and they've expanded their services to include everyone from students to small business owners. Their mission remains the same: offer quality coverage at competitive prices.

One of the coolest things about GEICO is their commitment to customer service. They’ve got 24/7 support, tons of resources online, and even an app that makes managing your policy a breeze. Plus, they're always rolling out new discounts and perks for their members.

Why Choose GEICO?

There are plenty of insurance companies out there, so why should you choose GEICO? Here are a few reasons why GEICO stands out:

- Competitive Rates: GEICO is famous for offering some of the lowest rates in the industry. They're constantly finding ways to keep costs down without sacrificing quality.

- Wide Range of Coverage: From auto insurance to boat insurance, GEICO's got you covered no matter what you need. They even offer pet insurance, which is a game-changer for animal lovers.

- Easy to Use: Getting a GEICO insurance quote is super simple. You can do it online, over the phone, or even through their app. Plus, their website is packed with helpful tools and resources to make the process as smooth as possible.

But don't just take our word for it. GEICO consistently ranks high in customer satisfaction surveys, and their reputation speaks for itself.

Read also:Jessica Clark Ohio The Untold Story You Need To Know

How to Get a GEICO Insurance Quote

Alright, let's get down to business. If you're ready to get a GEICO insurance quote, here's how you can do it:

Step 1: Gather Your Info

Before you start the quoting process, make sure you have all the necessary info handy. This includes:

- Your personal details (name, address, date of birth)

- Your vehicle information (make, model, year)

- Your driving history (accidents, tickets, etc.)

- Any current insurance policies you have

Having everything organized beforehand will save you a ton of time and hassle.

Step 2: Choose Your Method

GEICO makes it easy to get a quote in three different ways:

- Online: Head to their website and fill out the quick form. It usually takes less than 10 minutes.

- Phone: Call their customer service line and speak with a live agent who can guide you through the process.

- App: Download the GEICO Mobile app and get a quote right from your phone.

No matter which method you choose, the process is straightforward and user-friendly.

Factors Affecting Your GEICO Insurance Price

Now, here's the part where we talk about what affects your GEICO insurance quote. There are several factors that go into determining your premium, and understanding them can help you save big bucks.

1. Your Driving Record

Let's be real: if you've got a clean driving record, you're gonna get better rates. Accidents, speeding tickets, and DUIs can all drive up your premium. But don't worry, GEICO offers programs to help you improve your driving skills and reduce your costs over time.

2. Your Vehicle

Not all cars are created equal when it comes to insurance. Sports cars and luxury vehicles tend to cost more to insure than sedans or compact cars. The age and condition of your vehicle also play a role.

3. Coverage Options

Do you want basic liability coverage, or do you need comprehensive and collision? The more coverage you choose, the higher your premium will be. It's important to find the right balance between cost and protection.

These are just a few of the factors that influence your GEICO insurance quote. There are plenty more, like where you live, how much you drive, and even your credit score.

Types of Insurance GEICO Offers

GEICO isn't just about car insurance. They offer a wide range of policies to meet your needs. Here's a quick rundown:

- Auto Insurance: Their bread and butter. Covers your car in case of accidents, theft, or damage.

- Homeowners Insurance: Protects your home and belongings from disasters, break-ins, and more.

- Renter's Insurance: Ideal for apartment dwellers who want peace of mind without the high cost of homeowners insurance.

- Boat Insurance: Keep your watercraft safe and secure with specialized coverage.

- Pet Insurance: Yes, you read that right. GEICO offers plans to cover your furry friends' medical expenses.

With so many options available, GEICO has something for everyone.

Tips for Saving on GEICO Insurance

Who doesn't love saving money? Here are a few tips to help you get the most out of your GEICO insurance quote:

- Bundle Policies: Combine multiple policies (like auto and homeowners) to get a sweet discount.

- Take a Defensive Driving Course: Completing one of these courses can qualify you for reduced rates.

- Drive Safely: Keep your record clean and watch those savings roll in.

These are just a few ways to shave off some bucks from your premium. GEICO also offers discounts for good students, military members, and even paperless billing.

Common Questions About GEICO Quotes

Got questions? We've got answers. Here are some of the most frequently asked questions about getting a GEICO insurance quote:

Q: How long does it take to get a quote?

A: Usually less than 10 minutes online or over the phone.

Q: Do I need to provide my social security number?

A: Not necessarily. GEICO can often provide an estimate without it, but providing it may give you a more accurate quote.

Q: Can I change my coverage after getting a quote?

A: Absolutely! You can adjust your coverage anytime through their website or by contacting customer service.

Customer Experience with GEICO

At the end of the day, customer experience is key. GEICO prides itself on delivering top-notch service, and their customers agree. Whether it's through their friendly agents, fast claims processing, or easy-to-use digital tools, GEICO makes managing your insurance a breeze.

But don't just take our word for it. Check out some of the reviews online to see what real customers are saying. Odds are, you'll be impressed.

Comparison with Other Insurance Providers

While GEICO is great, it's always smart to compare your options. Other big names in the insurance game include State Farm, Allstate, and Progressive. Each company has its own strengths and weaknesses, so it's worth shopping around to find the best fit for you.

That said, GEICO's combination of affordability, coverage options, and customer service makes them a strong contender in the market.

Final Thoughts

Getting a GEICO insurance quote doesn't have to be a chore. With their user-friendly platform, competitive rates, and wide range of coverage options, GEICO is a solid choice for anyone in the market for insurance.

So what are you waiting for? Head over to their website, download their app, or give them a call today. And don't forget to share this guide with your friends and family. The more people who know about GEICO's awesome deals, the better!

Have any questions or feedback? Drop a comment below or reach out to us on social media. We'd love to hear from you!